———————————————————-

Thursday, January 23, 2020 11:09 am EST

———————————————————-

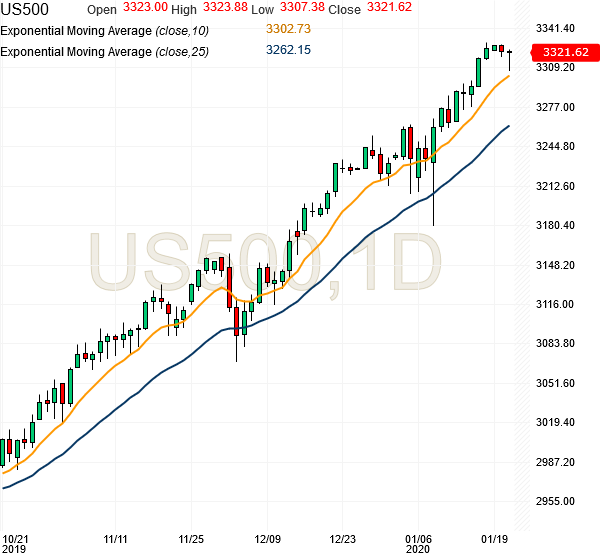

Hello Folks, the S&P500 futures are at 3307.25

Today’s Range (so far): 3301.50 – 3321.25

As expected with 50-50 chance, the futures went down today till 3301, and have bounced back, and both 3300 and 3310 support levels are getting tested currently. But we can’t say as of now, whether this bounce back is enough for testing the support of whether the futures will go down till 3290 for complete support testing.

The set up of today has clarified our next General Trade, which will come once the futures start moving up again. Here is the next General Trade.

Trade#4 of Jan 2020

“Buy at 3323 for Target 3343 with Stop loss 3308”

———————————————————-

Update: The above trade got activated by end of today.

———————————————————-

Thursday, January 23, 2020 8:16 am EST

———————————————————-

Hello Folks, the S&P500 futures are at 3313.50

Today’s Range (so far): 3312.00 – 3321.25

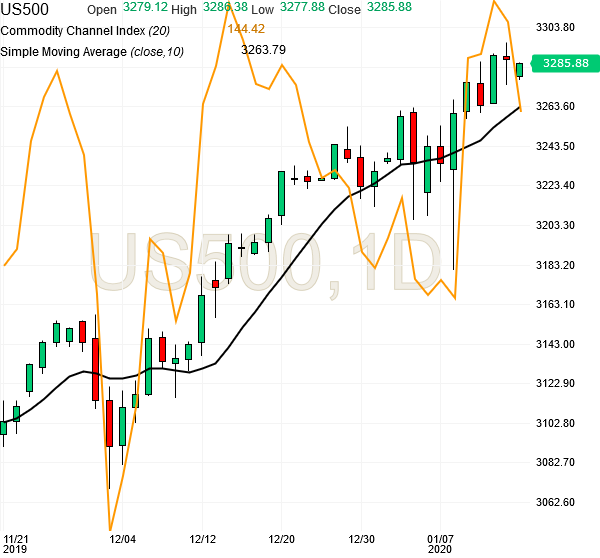

The set up is fairly good, but still it’s not fully suitable for a new General Trade, because there is a 50-50 chance of a retest of 3300 level, which maybe a downward spike that will take out many stop losses. So, we don’t want to risk our existing gains of the month. However, the current set up is a fairly good for a new long trade with 10 point Stop loss, which we can do as an Optional Trade below.

[Bonus Trade]

“Buy at 3315 for Target 3333 with Stop loss 3300.”

This trade will trigger right away. Thanks.

Update: The above Bonus Trade got activated by end of Thursday, January 23,

and hit target 3333 on Friday, January 24, within 24 hours of trade starting.