Hello Folks, the S&P500 futures are at 3289.00

The futures went down till 3240 with gap down today morning and by end of day, they bounced back sharply to 3289, and there by closed above 3280. Continue reading

Tag Archives: SP500 Trading Strategy

Emini Futures Trading Analysis- 27Jan2020

Hello Folks, the S&P500 futures are at 3244.00

Today’s Range (so far): 3235.75 – 3268.50

The futures are down 50 points from Friday’s closing. There was a gap down opening of 25 points below Friday’s closing of 3293, and the futures have gone down further on liquidation of long positions with stop losses. As we mentioned earlier, the futures can correct rapidly below 3300, and that has played out since Friday evening. That’s why 3300-3290 were last Stop loss on our General Trades.

In the very short term, the hourly charts are now showing positive momentum, which can support price from falling further. But this quick 100 point correction from 3337 to 3235 has broken many support levels, and rework is needed at each key level like 3250, 3280, 3300.

Most importantly, the strong uptrend that started on 10th Oct 2019 is at risk currently, unless the futures move above 3280 within this week.

The key support levels on the downside are at 3200 and 3180, but the futures may not go there directly, and there maybe upward spikes. The S&P500 futures will be strong above 3260, and fresh selling pressure will come below 3180. Trades with 10-20 point Stop loss will not work in current conditions of high volatility. Position size needs to be smaller, and Stop loss needs to be wider.

This is an unforeseen event based correction, and its difficult to predict how much impact it will have. We have to let the big market players decide the market direction in the next 2-3 days, while we observe carefully. We should avoid new trades till we get some clarity. Thanks.

Emini Futures Trading Analysis- 24Jan2020

If you were actively trading SP500 Futures this week, then this post is for you.

Friday’s intraday fall of 56 points in SP500 futures was unexpected and it caught almost everybody by suprise, and it broke many long positions that were created based on the strong bullish move of Thursday, Jan 23. The fall is being attributed to China Coronavirus concerns on global growth, which caused cascading Stop losses on various long positions between 3320 to 3290.

We got a sense of something not going right at 3323-3325 level because the futures should not have come back there today at all! Plus the fact that they did not make a new high today and they could not cross the previous high of 3337, made things bearish at 3325. That’s when we decided to close the ongoing long trade at or near cost price. Some traders who wanted to hold a few long positions with 3300 Stop loss also got hit, and our final Stop loss on all long postions was 3290, which was also hit.

While a retest of 3300 support level was looking possible from the start of the week, a test of 3280 within the same session was not visible. It shows that a significant amount of long positions got hit with Stop loss yesterday.

But the SP500 futures uptrend, which started in Oct 2019, is still intact, and fresh long positions can be created above 3300 for targets of 3330-3350. The support level is at 3370-3380, but we have to be careful, because below 3300, even 3250 level can get tested in the coming week – it depends on the intensity of negative news coming from China.

The futures will rapidly gain strength above 3300, and Traders should consider adding new long positions, plus all the Stop loss positions will also attempt to add back their long positions. Therefore the price recovery above 3300 can be rapid. The range for next week can be 3250 on downside and 3350 on upside. A more likely range would be 3270 to 3330. So, we are seeing 3330 level coming back at least once, and we should aim to use that. Thanks.

Emini Futures Trading Analysis- 23Jan2020

———————————————————-

Thursday, January 23, 2020 11:09 am EST

———————————————————-

Hello Folks, the S&P500 futures are at 3307.25

Today’s Range (so far): 3301.50 – 3321.25

As expected with 50-50 chance, the futures went down today till 3301, and have bounced back, and both 3300 and 3310 support levels are getting tested currently. But we can’t say as of now, whether this bounce back is enough for testing the support of whether the futures will go down till 3290 for complete support testing.

The set up of today has clarified our next General Trade, which will come once the futures start moving up again. Here is the next General Trade.

Trade#4 of Jan 2020

“Buy at 3323 for Target 3343 with Stop loss 3308”

———————————————————-

Update: The above trade got activated by end of today.

———————————————————-

Thursday, January 23, 2020 8:16 am EST

———————————————————-

Hello Folks, the S&P500 futures are at 3313.50

Today’s Range (so far): 3312.00 – 3321.25

The set up is fairly good, but still it’s not fully suitable for a new General Trade, because there is a 50-50 chance of a retest of 3300 level, which maybe a downward spike that will take out many stop losses. So, we don’t want to risk our existing gains of the month. However, the current set up is a fairly good for a new long trade with 10 point Stop loss, which we can do as an Optional Trade below.

[Bonus Trade]

“Buy at 3315 for Target 3333 with Stop loss 3300.”

This trade will trigger right away. Thanks.

Update: The above Bonus Trade got activated by end of Thursday, January 23,

and hit target 3333 on Friday, January 24, within 24 hours of trade starting.

Emini Futures Trading Analysis- 21Jan2020

Hello Folks, the S&P500 futures are at 3321.50

Today’s Range (so far): 3307.50 – 3325.50

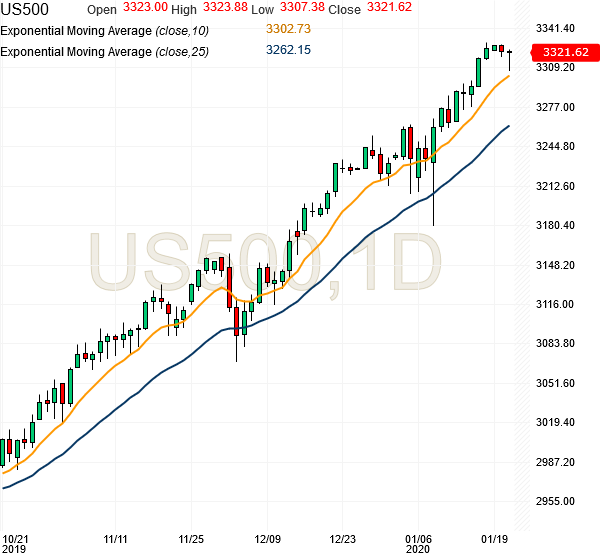

S&P500 Futures Technical Analysis: The futures are facing profit taking after moving to new life time highs of 3325-3330, which is very normal. Last week was positive and this week is looking okay as of now. We could see retest of 3300-3290 this week on the downside, and we could see 3340-3350 on the upside. The futures are trying to move up currently. Today’s close will be an important indication.

Our SP500 Emini Futures Trading Strategy continues to be the same. We want to buy on corrections and sell with 20-30 points gain. We may get a new General Trade today, based on how the futures handle 3310-3320 level. Please stay alert. Thanks.

[Bonus Trade]

“Buy at 3313 for Target 3333 with Stop loss 3293.”

This trade may trigger today or tomorrow morning.

Note on Position Size: Please note that we can trade max 1 Emini Contract (50 futures) for every $10K trading capital. So max 2 Emini Contracts (100 futures) for $20K capital, and max 10 Emini Contracts (500 futures) for $100K capital. Position size management is very critical for success in futures trading, because it enables us to navigate different types of market conditions without breaking down. Thanks.