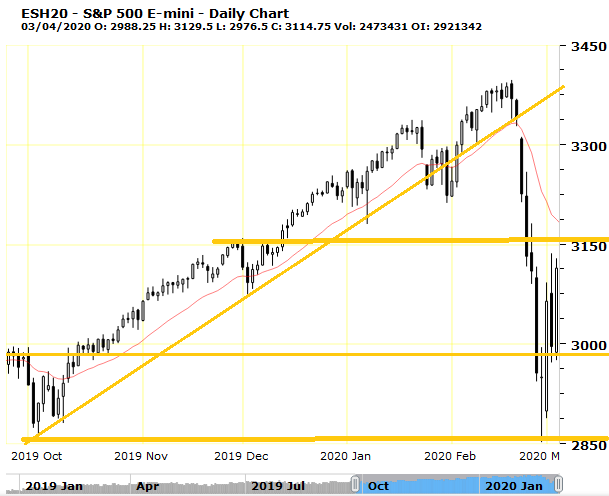

The S&P500 futures closed at 3114. It was a big green day, after a big red day. These are all indicative of the market trying to adjust itself. A retest of 200 day moving avg (3068) is sure to come tomorrow, 5th March. Traders should take profits around 3100 and wait for lower levels like 3050 to consider a new trade. 3050 should provide short term support, but 2970 is the real support on the downside.

Major resistance on the upside is at 3150, and major support on the downside is at 2850. So there is a 300 point band, in which the futures can decide their direction.

Our Emini Futures Trading Strategy is to be care careful, and take very few trades after careful observation. The market has not yet stabilized, so our position size must be small, to avoid sudden large loss.

[Bonus Trade]

Sell at 3090 for Target 3040 with Stop loss 3120.

This trade can give 50 points gain for 30 points risk. Unfortunately, in current market conditions, we can’t do any real trade with less than 30 point stop loss. 10-20 points are going away rapidly as if they are nothing. And support and resistance levels are also widely placed, as the S&P500 index is trying to navigate this period of high volatility.