Hello Folks, the S&P500 futures are currently at 3190.00

Today’s Range (so far): 3177.00 – 3191.25

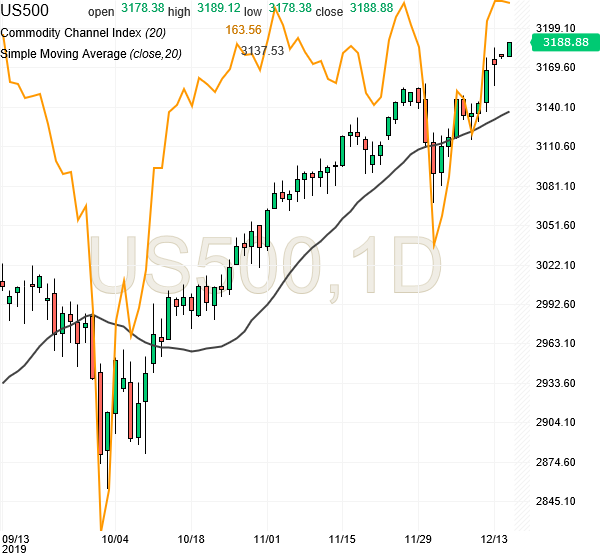

The futures have moved up on positive news regarding US-China trade deal. However, the futures are now in overbought zone, and we can see quick 20-30 point correction on any negative news. The resistance at 3180 has been crossed but really tested, so the current setup does not have a clean trade. So there is no new General Trade currently. We have to wait and watch.

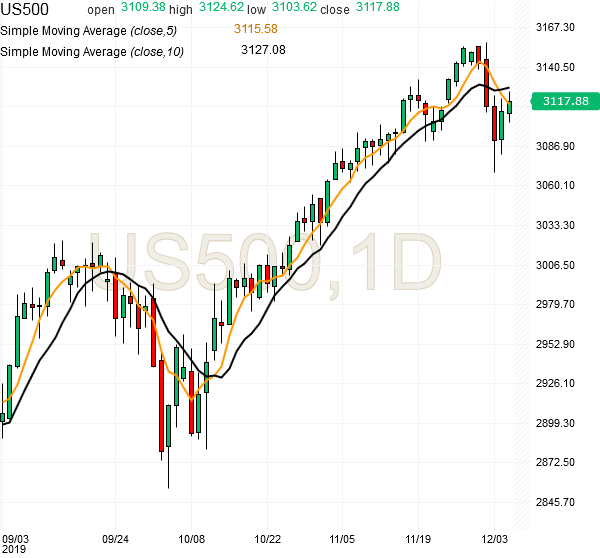

The S&P500 trend is clearly up, and buying on correction is the profitable S&P500 futures trading strategy, while the futures are above 3000. The immediate support is at 3120-3140 level, and upside target is 3220, which is 30 points above current price of 3190. The S&P500 futures are facing stalling momentum, and they may try to test 3150-3160 levels by next week.

Traders with 10+ contracts: Here is an Optional Trade with 1-2 contracts.

“Buy at 3190 for Target 3210 with Stop loss 3170”

This trade has 50-50 chance of success and its not suitable for all traders.

At the start of year 2019, when the futures were near 2500, we had given our yearly target as 3000, which came long ago, and we have made good gains this year using 3000 as constant upside target, buying all corrections towards 2800. Now, we should remain cautious at current level of 3190. Thanks.