S&P500 Emini Futures have been trading in a tight range between 2080 to 2090 for last several days, with support at 2070. Therefore, as long as 2070 holds, the most likely targets are 2100 and 2120. The trend is up and we should stay long. If for any reason, the index starts falling, then short trades can be started from 2060 with stop loss at 2070. The probability of sudden fall is less because the index has been spending time and consolidating at the current level of 2085, waiting for the Thanksgiving holidays to get over.

Tag Archives: Emini Trading Strategy

Emini Futures Chart Analysis – 10Nov2015

Date:Nov 10, 2015 Open=2072.25 High=2079.00 Low=2064.50 Close=2078.10

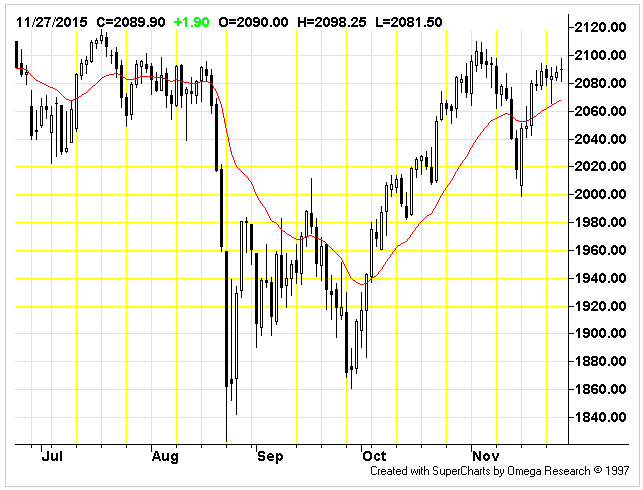

S&P500 Index is currently in uptrend, after forming a solid double-bottom at 1860-1870 level in early October 2015. The index has come back above 2050-2100 level from where it fell during Aug-Sep 2015. As long as S&P500 Index is above 2000 level, the uptrend remains intact, and we should remain long with futures. Below 2000, longs must be closed immediately, because deep downsides can start. So the major stop loss for all long trades is 2000 on S&P500 Index. Active traders can do long side trades on S&P500 E-mini Futures with 15-20 points as stop loss.

For Large Traders of Emini Futures

If you can trade with 10+ Emini contracts, then contact us for our special emini trading proposal because Emini Futures Trading strategy is different when you can hold 10+ contracts for 1-4 weeks, which involves trading with fewer contracts (say 5 contracts at max), leaving ample capital as buffer so that when high conviction prices appear (which may come 1-2 times per month at max), wider stops (we don’t want market noise to hit our positions) and, most importantly, buying on “all-red days” when others are selling in fear, and selling on “all-green days” when everyone is happy, we are busy selling our inventory, because we need to free up capital for the next set of down days.

Day to day trading is not the way for long term profitable trading. Some of the best gains with Emini futures trading come over 1-2 weeks once a market is trending up or down. Even sideways markets in a range can give good trades. Please see the Emini Futures Trading performance data.

The fee for this service starts from $3000 per month. We will communicate the trades to you by email, and we will speak with you on phone 2-3 times per week to keep you aligned with our trading strategy. You can expect to make 20 points more per month per contract, or $1000 per month per contract. Once we decide to enter the market at a particular level, we will have multiple buying points and multiple selling points, taking 5-10 points per trade. This strategy is similar to the trading strategy used by market makers. Most of the trades are limit orders. In case of large number of contracts, we may use options to protect our positions. Please Contact us if you are interested. Thanks.