Wednesday, April 13, 2016, 9.45am, New York – Hello Folks, the futures are currently at 2069. For Trade#2 of April, our target of 2067 has been hit successfully today morning. I was expecting it to come by Friday as mentioned in the email last evening. But the momentum is strong and our target got hit today morning itself. This completes Trade#2, with 28 points gain from.

Trade#2 of April 2016 (completed)

------------------------------------

Buy at: 2039

Target: 2067 (hit on April 13, 2016)

Stop: 2030

------------------------------------

This trade has moved fast, and its good we took this immediately after our Stop Loss on Trade#1. We will wait for the index to take a breather after the hectic 40 point upmove from 2030 to 2070 in the last 2 days since Monday morning, and then decide our next trade.

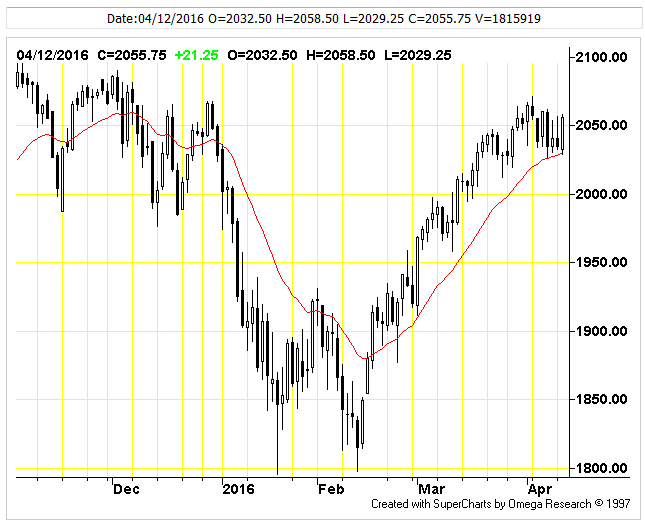

[Emini Futures Trading Strategy] The S&P500 has strong resistance at 2075-2080 level, which translates to about 2070-2073 levels on the SPX/ES futures. However, the S&P500 index is in positive buy zone above 2058, which translates to about 2050 level of the futures. If the S&P500 index goes below 2000 for any reason, all longs must be closed. Of course we will be having predefined Stops much above 2000 level.

[Bonus Trade] Large Traders with 5-10 contracts: You may Sell 2-3 contracts at 2068, for Target 2058, and Stop 2075. This is a tactical trade that aims to benefit from the inevitable profit booking that may come today or tomorrow. Thanks & Best Wishes.