—————————————————————

Date and Time: Wed, January 8, 2020 4:13 pm, New York Time

—————————————————————

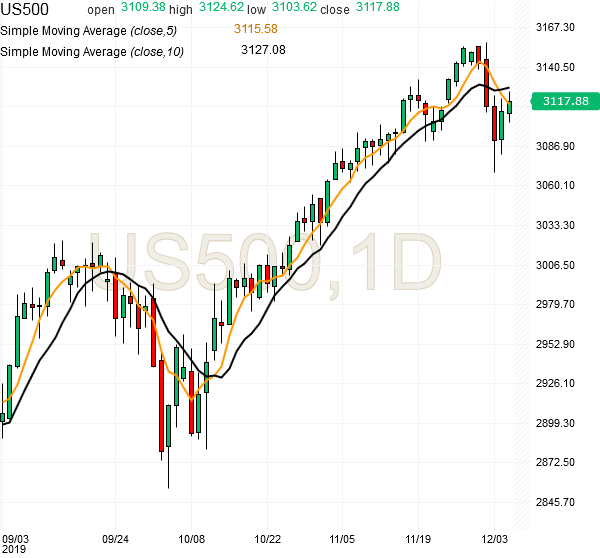

Hello Folks, the S&P500 futures are at 3258.50

Today’s Range: 3181.50 – 3267.50

The futures went up till 3267.50 today, and profit taking has come towards end of the day, and futures have come down to 3258. Today’s candlestick pattern on S&P500 futures is very rare. It is super bullish, but it is coming after a very good rally in last 8 weeks, so I have to study the entire market setup carefully tonight.

Overall, the setup is bullish above 3200, and 3220 is the main support level on the downside. The futures may try to test 3280 in the next 1-2 days. There is no new General Trade for now. Let me first complete my analysis of the current setup. I will mail you tomorrow morning with updates. Thanks.

—————————————————————

Date and Time: Wed, January 8, 2020 1:37 pm, New York Time

—————————————————————

Hello Folks, the S&P500 futures are at 3257.50

Today’s Range: 3181.50 – 3261.50

With S&P500 futures breaking below 3200, various negative scenarios were looking possible (that’s why the futures fell below 3200 in the first place!). So it was a lot of analysis effort last night (almost a night out) to decide the plan for today, but in the end it has paid off very well!! Continue reading