The S&P500 Emini futures are currently at 3131 in pre-market trading, up 10 points from yesterday’s closing of 3121.

Yesterday (Monday) was looking like a bearish setup during the day but the S&P500 Emini futures pulled up into green by the end of the day, and created a doji like candle, which indicated that the selling pressure was met with equal buying demand. Today’s pre-market upmove to 3131 indicates that we have some more bullish upmove potential, till 3150. However, if the futures start trading below 3110, which is below the low of yesterday, then selling pressure can increase rapidly and 3080 can be retested by end of Friday. So the market range is from 3080 to 3150.

[Bonus Trade] Buy at 3122 for Target 3145 with Stop loss 3110.

Yesterday’s low was 3111.25, so 3110 is a very suitable stop loss for this trade.

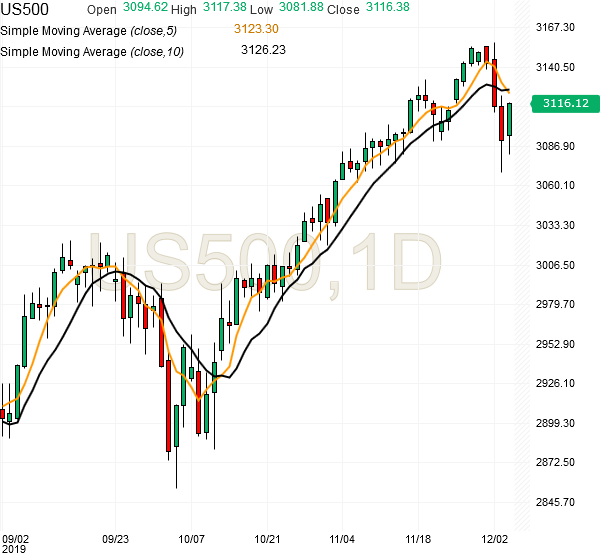

The weekly chart S&P500 futures is showing stalling of momentum, which indicates that we are probably near the top end of this rally now, and we may see a red weekly candle within the next 1-2 weeks, if not this week itself.

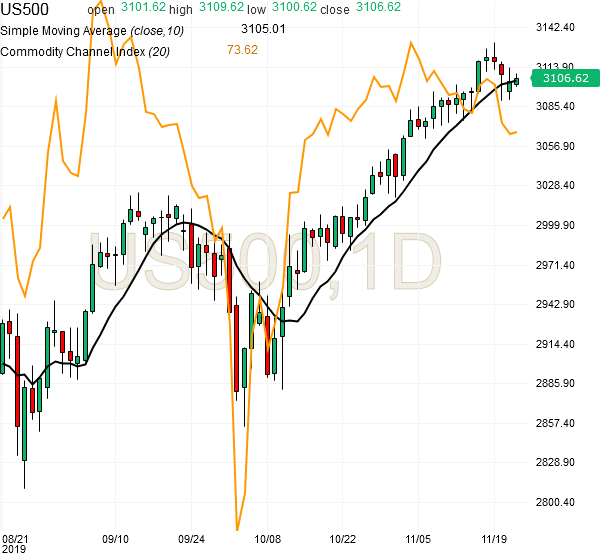

The daily chart of S&P500 futuresis showing reducing momentum in the latest part of this rally, compared to previous rally, so that is an indication of stalling in the price upmove in the near future, maybe in 3-5 days.

The hourly chart of S&P500 futures is showing strong momentum, which is supporting the current upmove from 3100 to 3131. But this hourly momentum can rapidly swing to downside once any strong selling comes, so we have to give more important to daily and weekly charts for understanding the market trend. The hourly chart will help us take a few tactical trades. For example, a long trade from 3100 to 3130 has been completed.