Hello Folks, Wishing you Merry Christmas and Happy New Year!!

May God bless you with great health, success and happiness!!

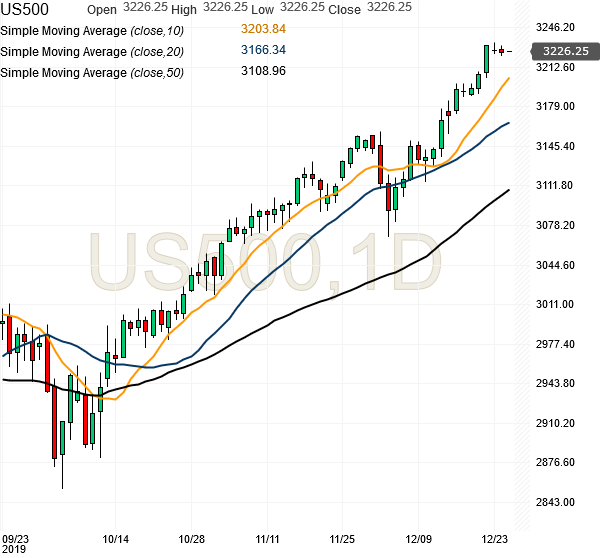

The #SP500 futures are at 3226. They have done a strong upmove in last few weeks. As mentioned multiple times in previous posts, we must stay long above 3000, and that has already given 200+ points gain.

The uptrend which started on 10 Oct 2019 is still intact, but there will be some inevitable profit taking that will come on any negative news. Therefore, at current level, we should take profits and have fewer long positions. 3200 is the absolute stop loss or cut off for any long trade at current level.

The monthly chart of SP500 futures is still bullish, and we may see further upmove in Jan 2020, but we can consider new trades for Jan 2020 once we are there. So we should be cautious, but maintain long view above 3200. Above 3220, the target is 3250.

Here’s a Bonus Trade:

“Buy at 3223 for Target 3249 with Stop loss 3200.”

Please Note: This trade has 50-50 chance of success, so it’s meant as an Optional Trade with 1-3 contracts for larger traders with surplus capital that is currently idle after profit taking. If you are trading with 4-5 Emini Contracts, you could try this trade with 1 contract. If you are trading with less than 4 Emini Contracts, then this trade is not suitable for your case. Its better to wait for more reliable setups.

Last year on 25 Dec 2018, the market was absolutely bearish (and we kept buying at the low levels to the extent possible, because a good rebound was sure from such low levels) and indeed things turned around in Jan 2019. And today on 25 Dec 2019, the market looks absolutely bullish, with very high (near record) levels of optimism by investors and traders and record high activity in Call options. Such situations usually don’t give good gains in the short term.

The major support is at 3020 level, which is 200 points down from current level. That 3020-3030 level was a major resistance earlier and it took several attempts to cross it, so now it will provide strong support.

Year 2019 has given one of the best gains in last 20 years, and we can’t expect such years again and again. The market will have to absorb these gains, which will require some consolidation, so we may see prices trying to consolidate around 3000-3200 in the coming year 2020. Year 2020 is also a US Presidential Election Year, so there will higher volatility, especially in H2, 2020. We will need to work with tight stop losses and clear targets in all our trades, and we must remain very alert and agile. Thanks!